This section allows you to configure the general rules for calculating employee payroll. Proper setup ensures accurate revenue tracking and fair reward allocation for your team.

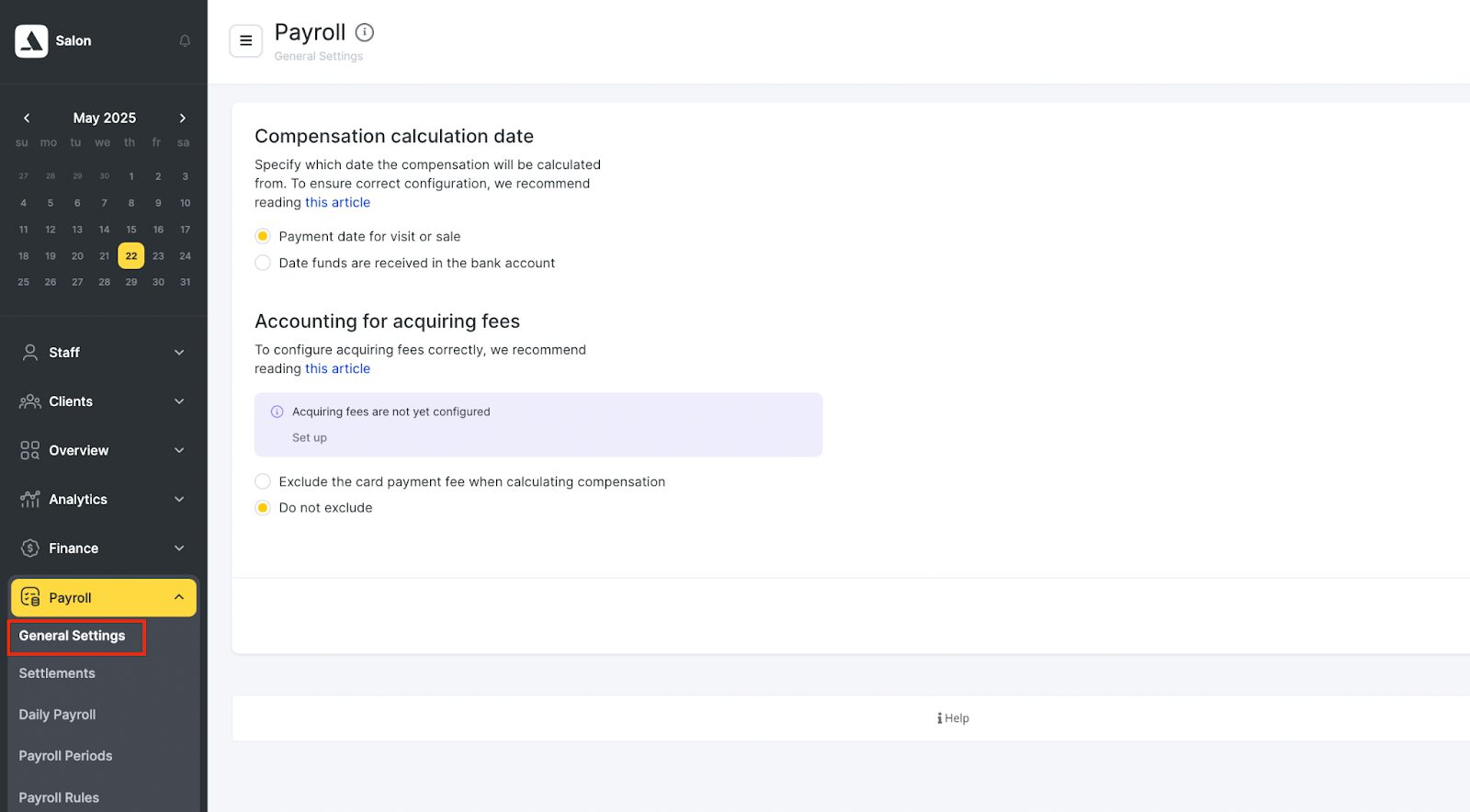

How to Access This Section #

- In the left-hand menu, go to Payroll.

- Click on General Settings.

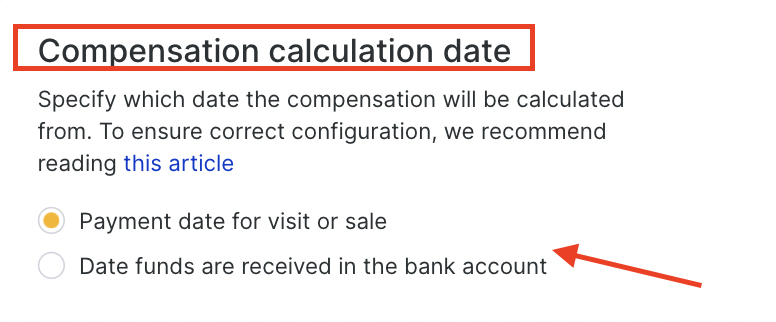

Compensation Calculation Date Setting #

Select the date basis on which the employee rewards will be calculated:

- Payment date for visit or sale – use this option if employee payout should be based on when the service or product was actually paid for (e.g., cash or card).

- Date funds are received in the bank account – ideal if the payout depends on the actual receipt of funds (e.g., in case of card payments with settlement delay).

This setting determines which transactions are included in the payroll calculations for a selected period.

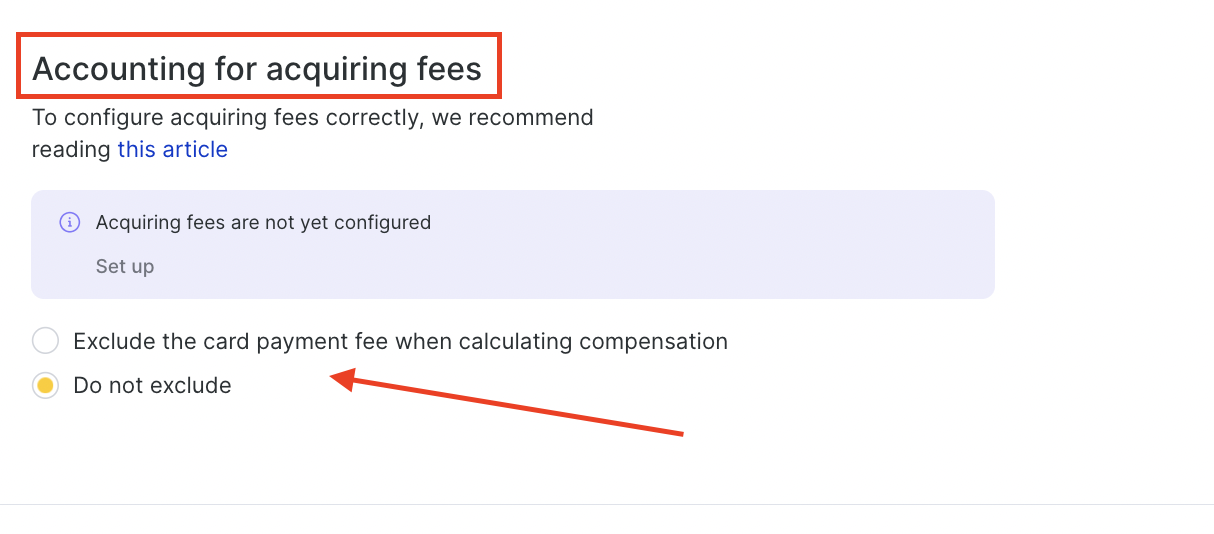

Acquiring Fees Handling #

Acquiring commission refers to the bank or payment service fee for card payments. You can choose whether this commission affects the employee’s reward calculation:

- Exclude the card payment fee when calculating compensation – the employee’s payout is based on the amount received after the fee is deducted.

- Do not exclude – the payout is calculated from the full payment amount, regardless of how the client paid.

If commissions are not yet configured, a notice will appear: “Acquiring fees are not yet configured.” Click “Set up” to open the configuration page. Read more about the section setup here.

Summary #

These settings let you fine-tune payroll calculations to match your business operations — such as accounting for delayed fund transfers or payment methods. Configuring this properly ensures transparency and fairness in employee compensation.