For various reasons, it may be necessary to refund a client for services, products, or a client account (deposit). In this article, we’ll look at different situations and options for processing refunds, as well as explain how to delete financial transactions directly in Altegio.

Full Refund for a Product and/or Service #

If a client cancels a service and/or returns a product, the payment is fully refunded.

A full refund is possible if:

- The service was provided only partially or of unsatisfactory quality.

- The client made a prepayment, but the appointment was canceled due to the business’s fault (professional illness, other unforeseen circumstances).

- The client is dissatisfied with the purchased product due to its quality.

You can completely delete a financial transaction in two ways:

1. In the Appointment Calendar

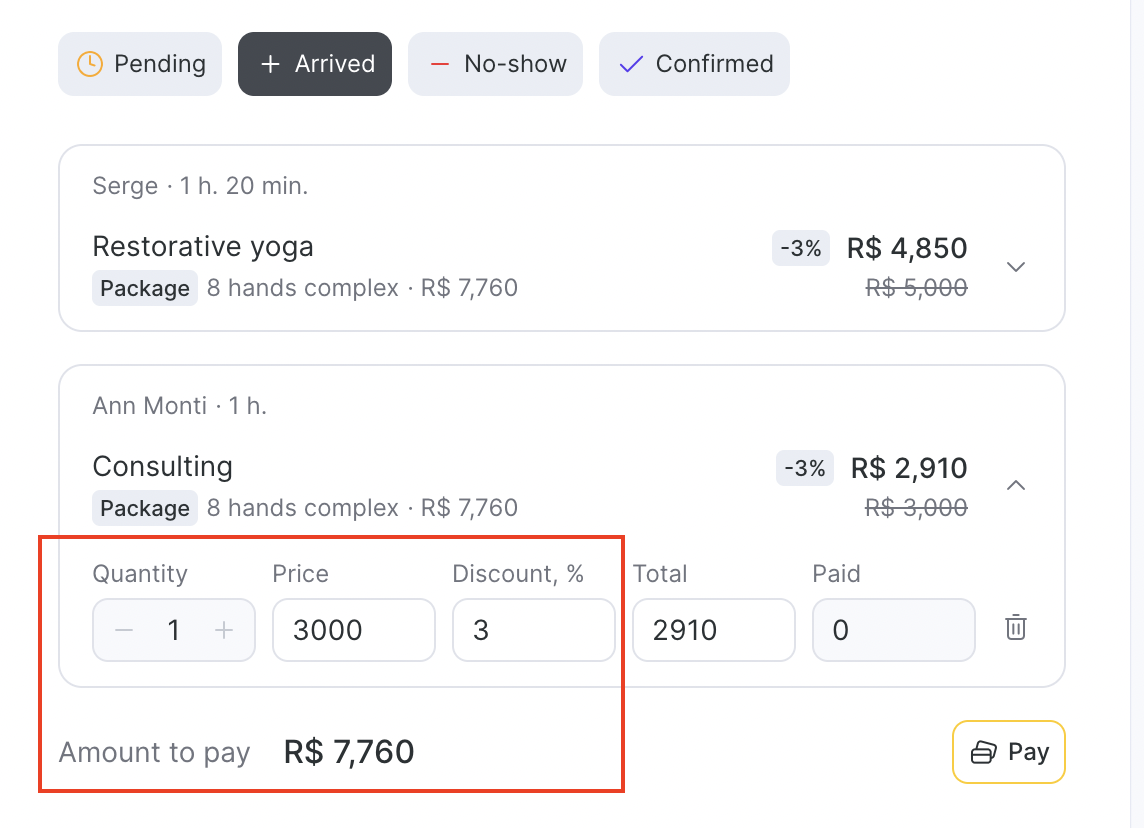

Open the appointment and go to the “Payment” tab. Next to the name of the service/product, click the downward arrow icon. A new line will appear showing the account where the payment was made, the amount, and a trash-bin icon. Click the trash-bin icon to cancel the payment — the financial transaction will then be deleted.

2. Using the “Finance” section

Go to Finance > Financial Transactions, find the required transaction, and click the date/time in the first column. This will open the payment document. In it, click the “Cancel” button to void the payment.

After a financial transaction is deleted, the visit status will change to “Visit not fully paid.” Depending on the situation, you can either delete the visit or leave it with a comment explaining why the client was refunded.

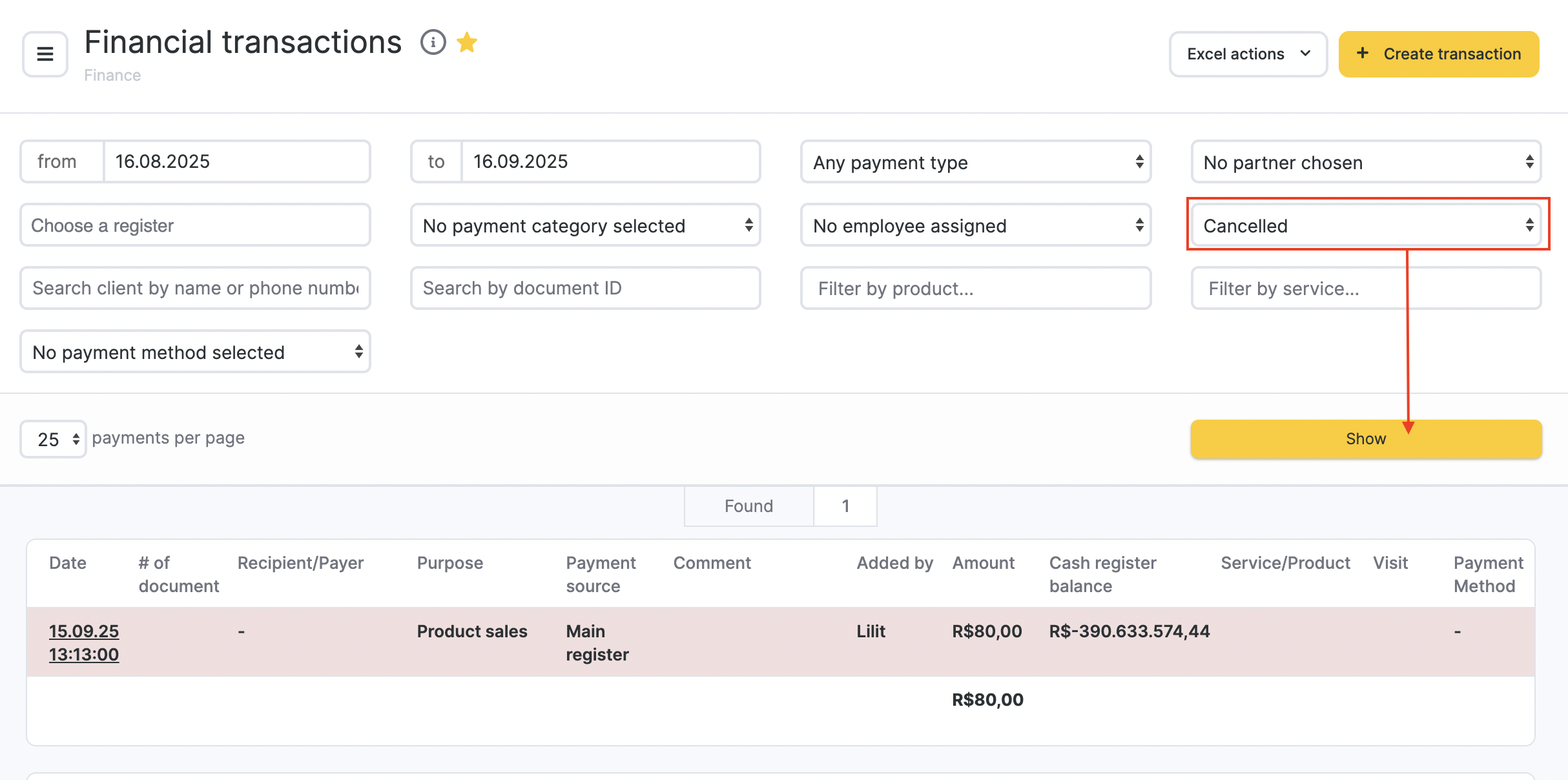

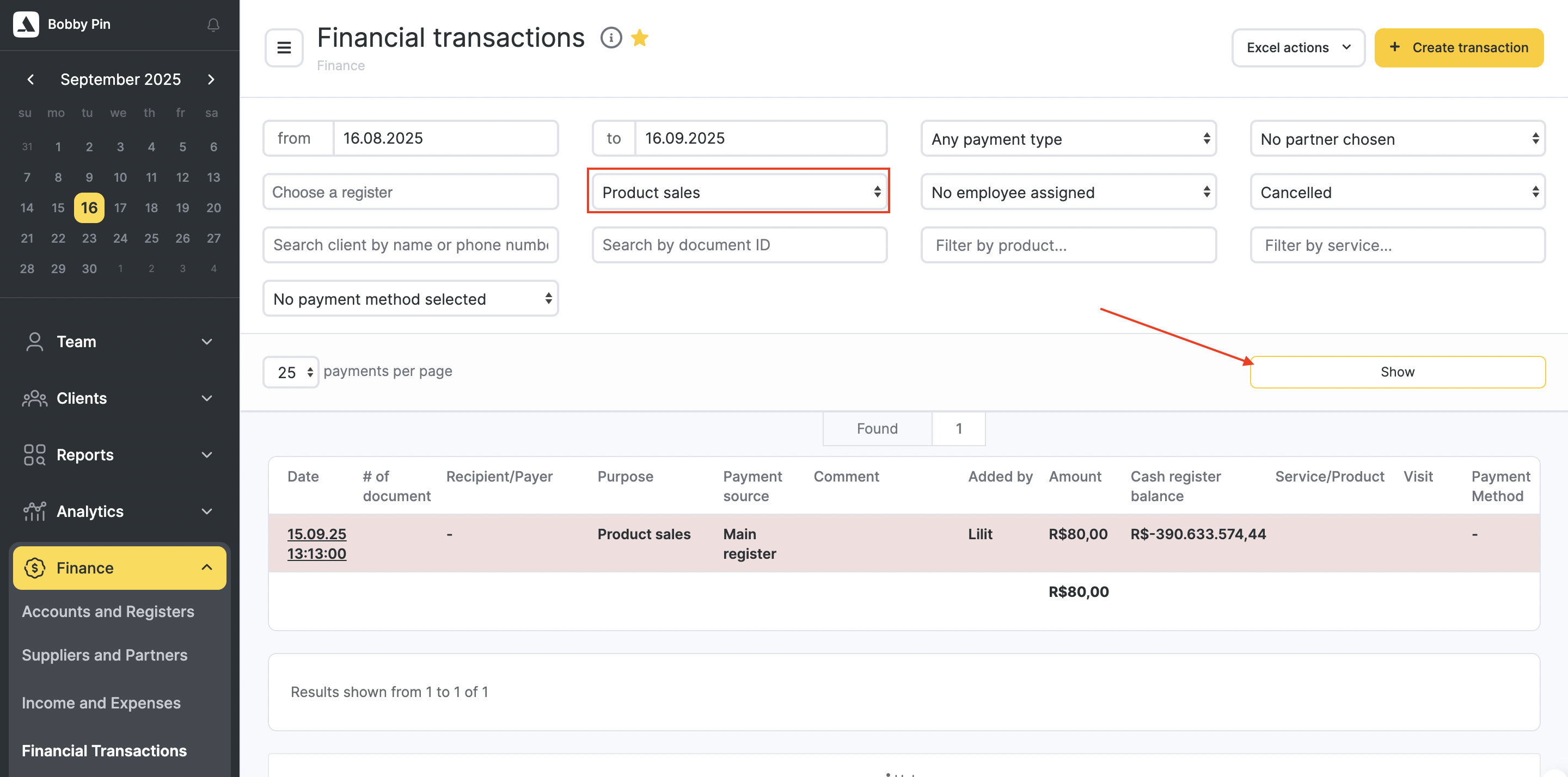

Information about the canceled payment will remain in Finance > Financial Transactions. To find deleted transactions, set the filter to “Canceled” and then click “Show.”

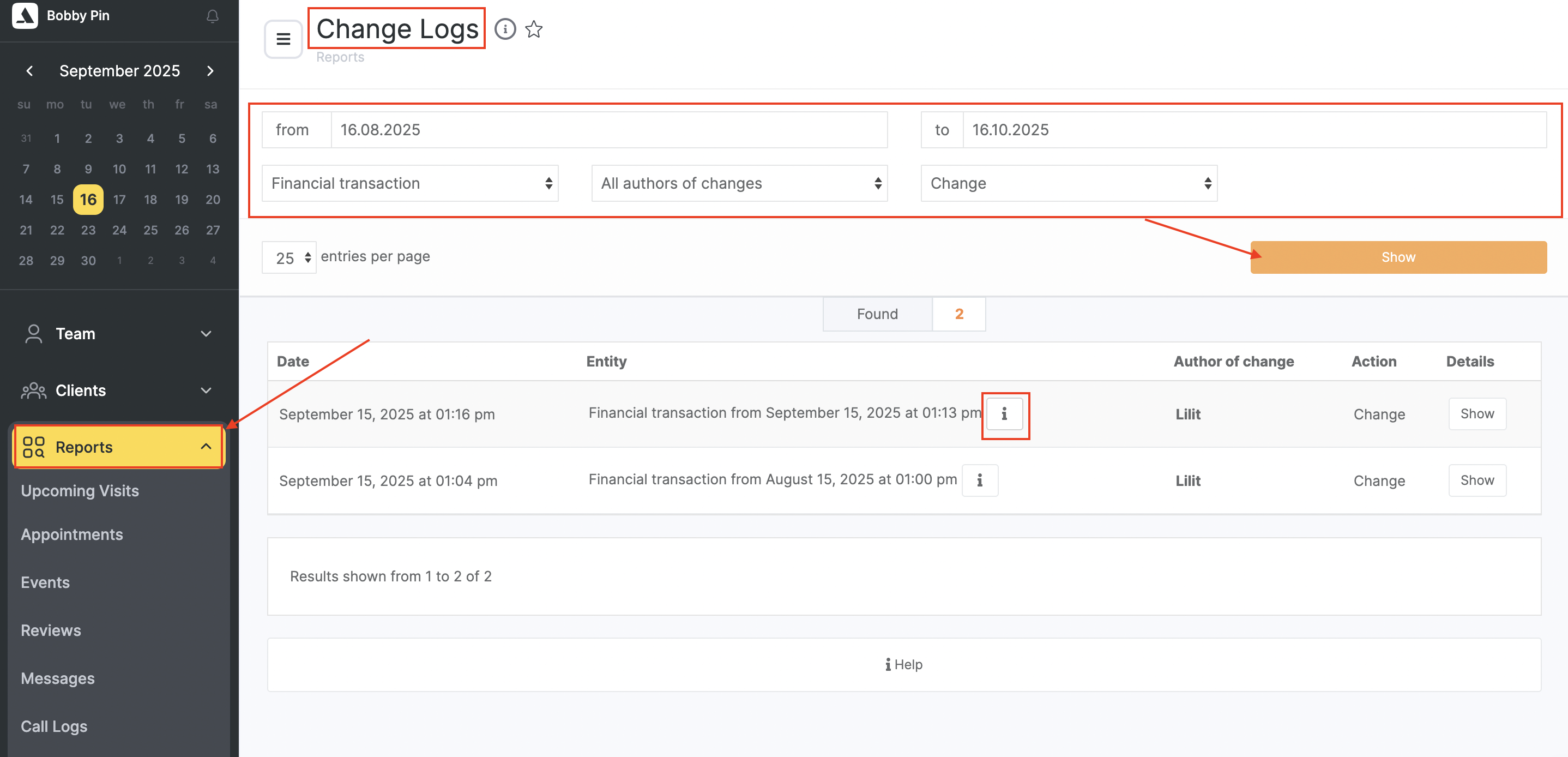

Information about deleted transactions will also appear in Reports > Change Logs. In this section, you can see which user added, changed, or deleted a payment, at what time, and view additional details and data.

2. Partial Refund for a Service

A partial refund is issued if the client is dissatisfied with the service or under other circumstances that require returning part of the previously paid amount.

To refund a portion of the amount to the customer, follow these steps:

- Cancel the payment for the service in the visit (see Step 1 above).

- Go to the “Visit Status” section and specify either the discount granted to the customer or the amount that should remain paid for this service. If you enter the payable amount directly, the “Discount” field will automatically be filled in.

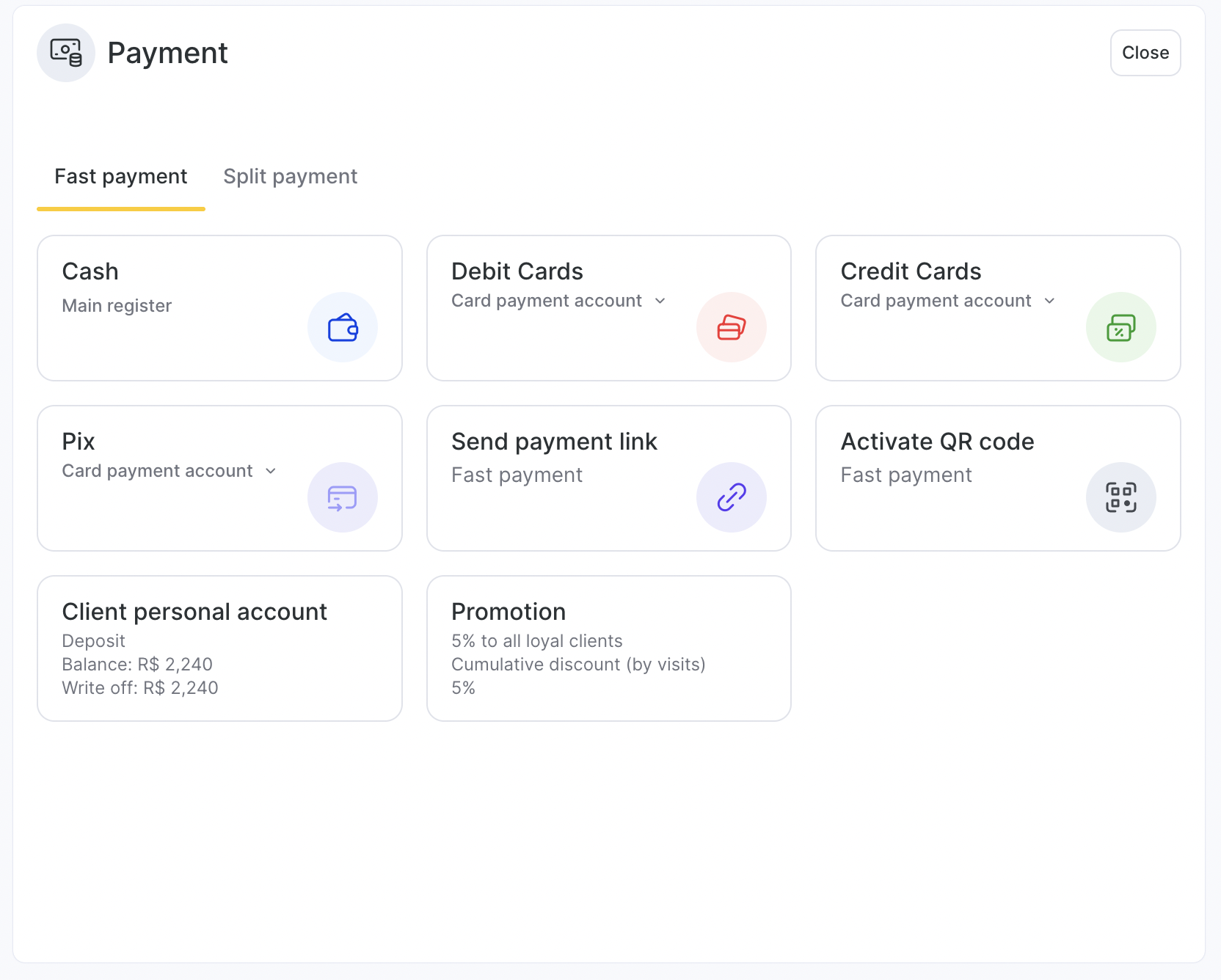

3. Go to the “Visit Payment” section and process the payment again. You can also make a fast payment from the “Visit Status” tab.

3. Full Refund for a Product Sold During a Visit (Without Refunding the Service)

If a client returns a product sold during a visit but keeps the service, the cost of the service is not refunded — only the product is refunded.

You can cancel the product payment in two ways: through Finance > Financial Transactions or directly within the visit.

To cancel the payment through Financial Transactions:

- Go to Finance > Financial Transactions, find the transaction for the product sale, and click the date/time in the first column. This will open the payment document. In it, click the “Cancel” button.

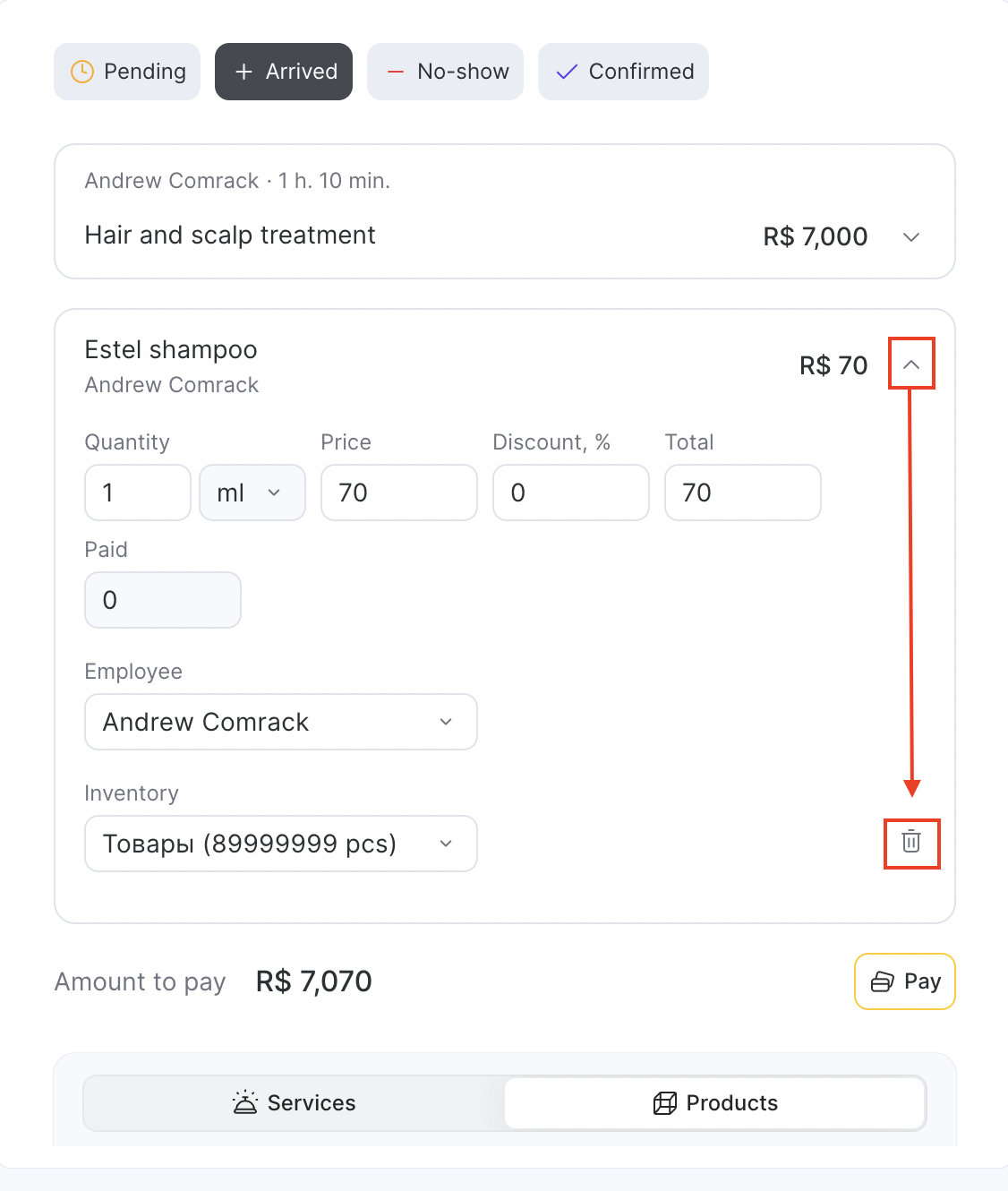

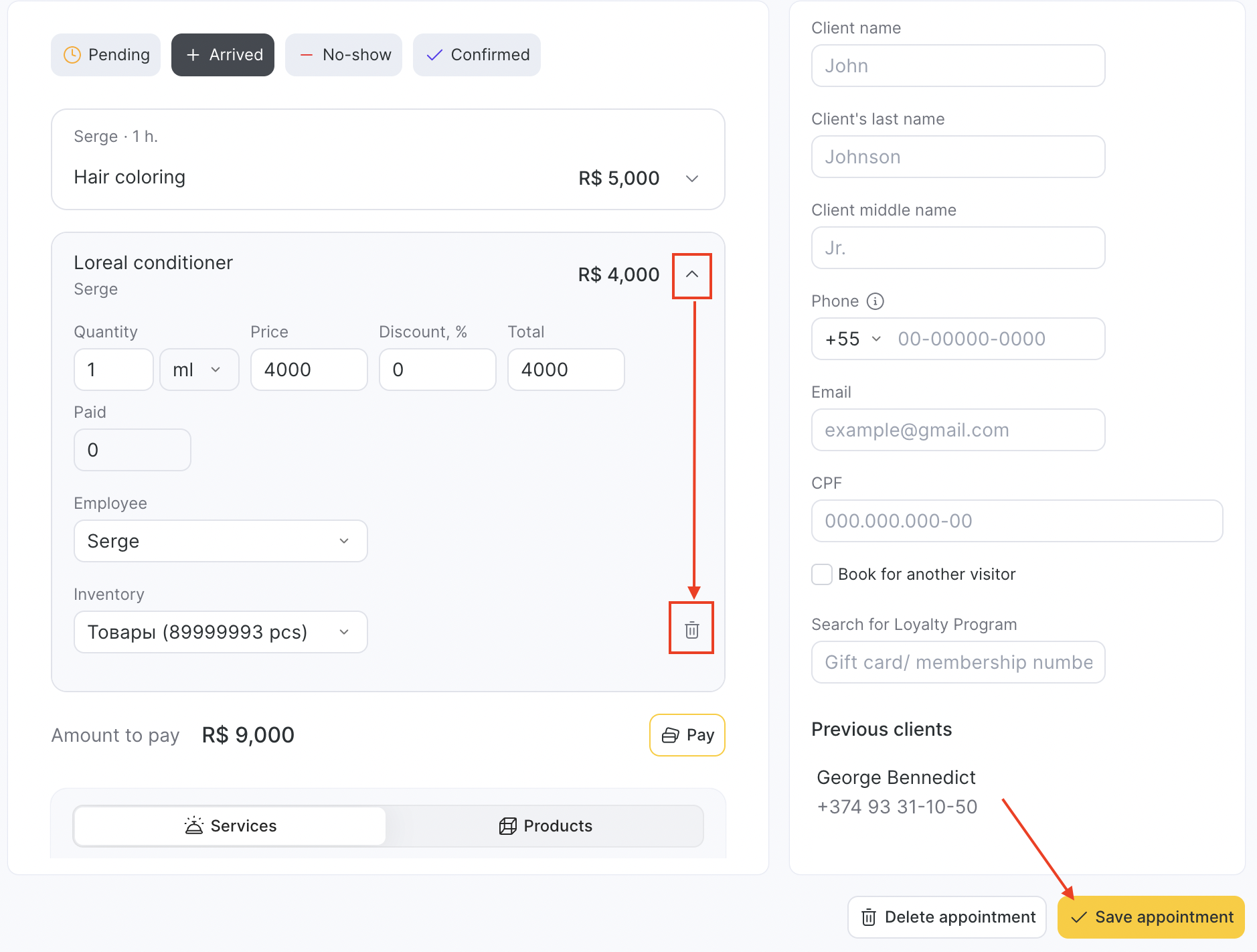

In the visit, go to the “Visit Status” tab and delete the product by clicking the trash-bin icon next to it.

After deleting the product, be sure to click the “Save” button at the bottom.

Second method to refund a product:

- Open the visit where the product was sold.

- Go to the “Visit Payment” tab and click the trash-bin icon under the product you want to refund.

Then go to the “Visit Status” tab and delete the product by clicking the trash-bin icon next to it.

After deleting the product, be sure to click the “Save” button at the bottom.

If you delete a product in the “Visit Status” tab before canceling its payment in the “Visit Payment” tab, an overpayment will appear in the visit for the amount of the deleted product. In this case, you’ll also need to go to Finance > Financial Transactions and cancel the payment document for that product transaction.

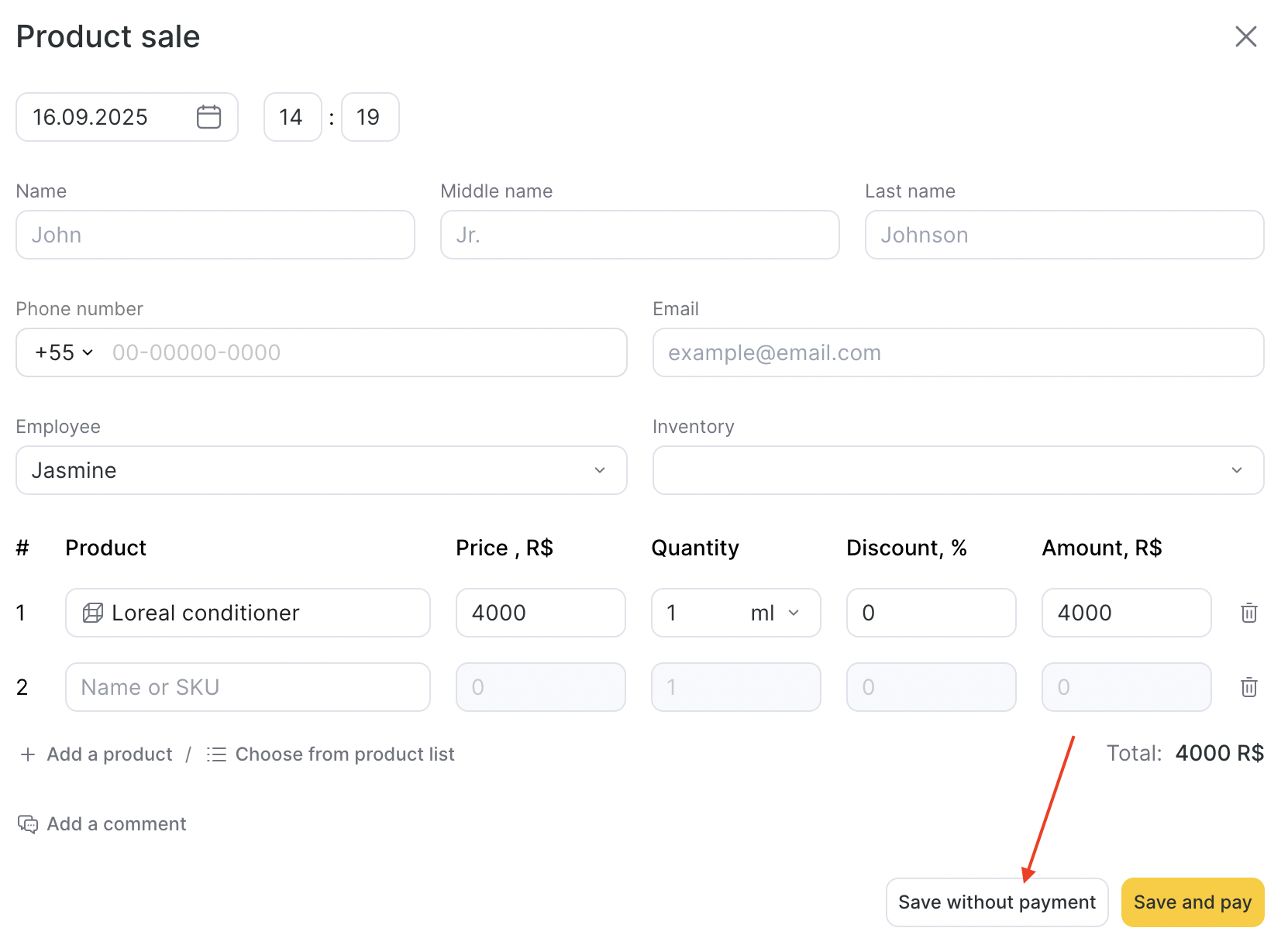

4 Refund for a Product Sold Separately from a Visit

To cancel the sale of a product if it was sold separately (outside of a visit):

- Go to Finance > Financial Transactions or Inventory > Inventory Management, find the product sale transaction, and click the date/time in the first column.

- The inventory transaction for the product sale will open — click the trash-bin icon in it.

- Be sure to click “Save Without Payment.” After clicking this button, both the financial and inventory sale transactions will be deleted.

Information about the canceled sale will remain in Finance > Financial Transactions and in Reports > Change Logs.

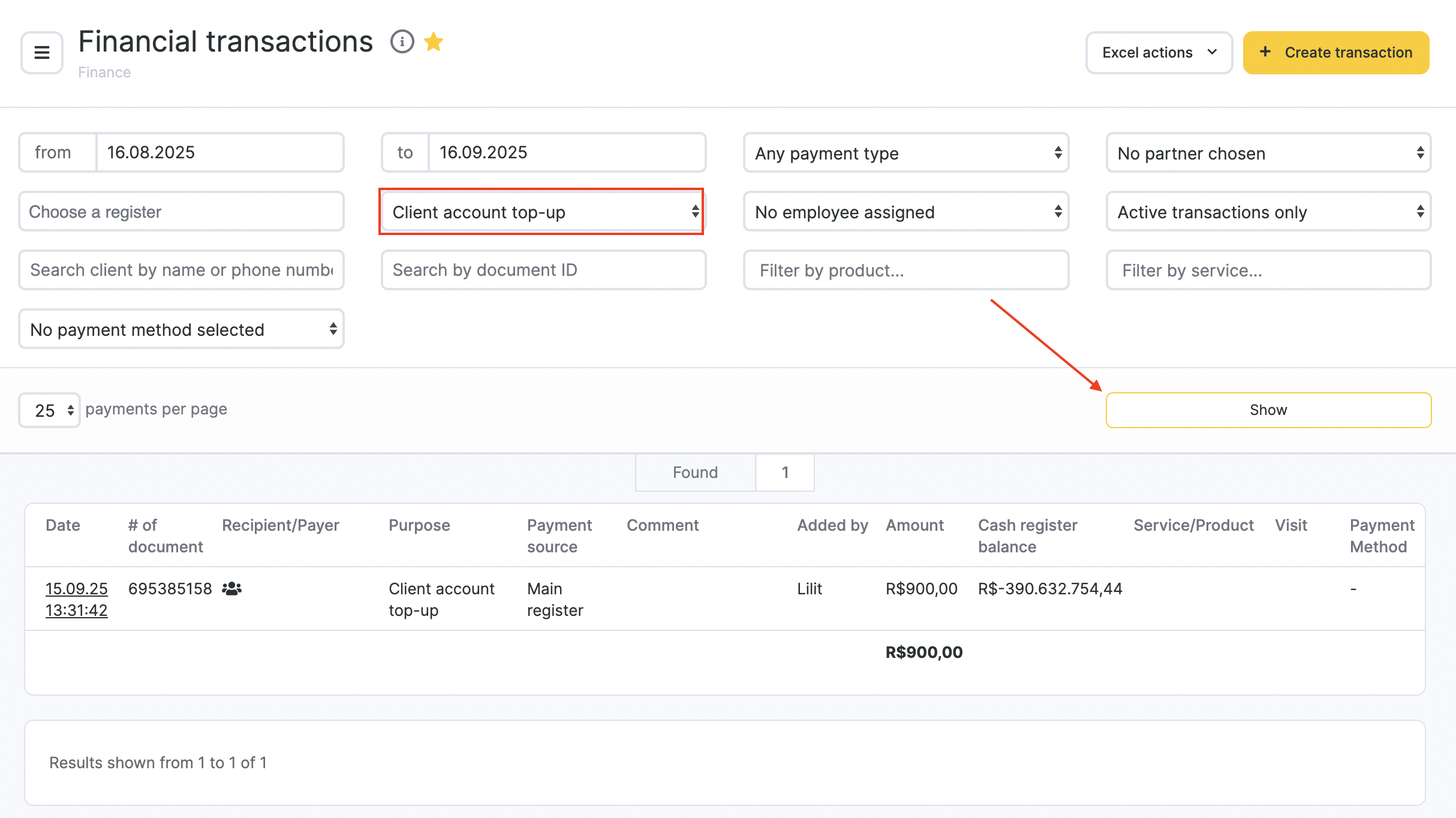

5. Full Refund of a Deposit from a Client’s Personal Account

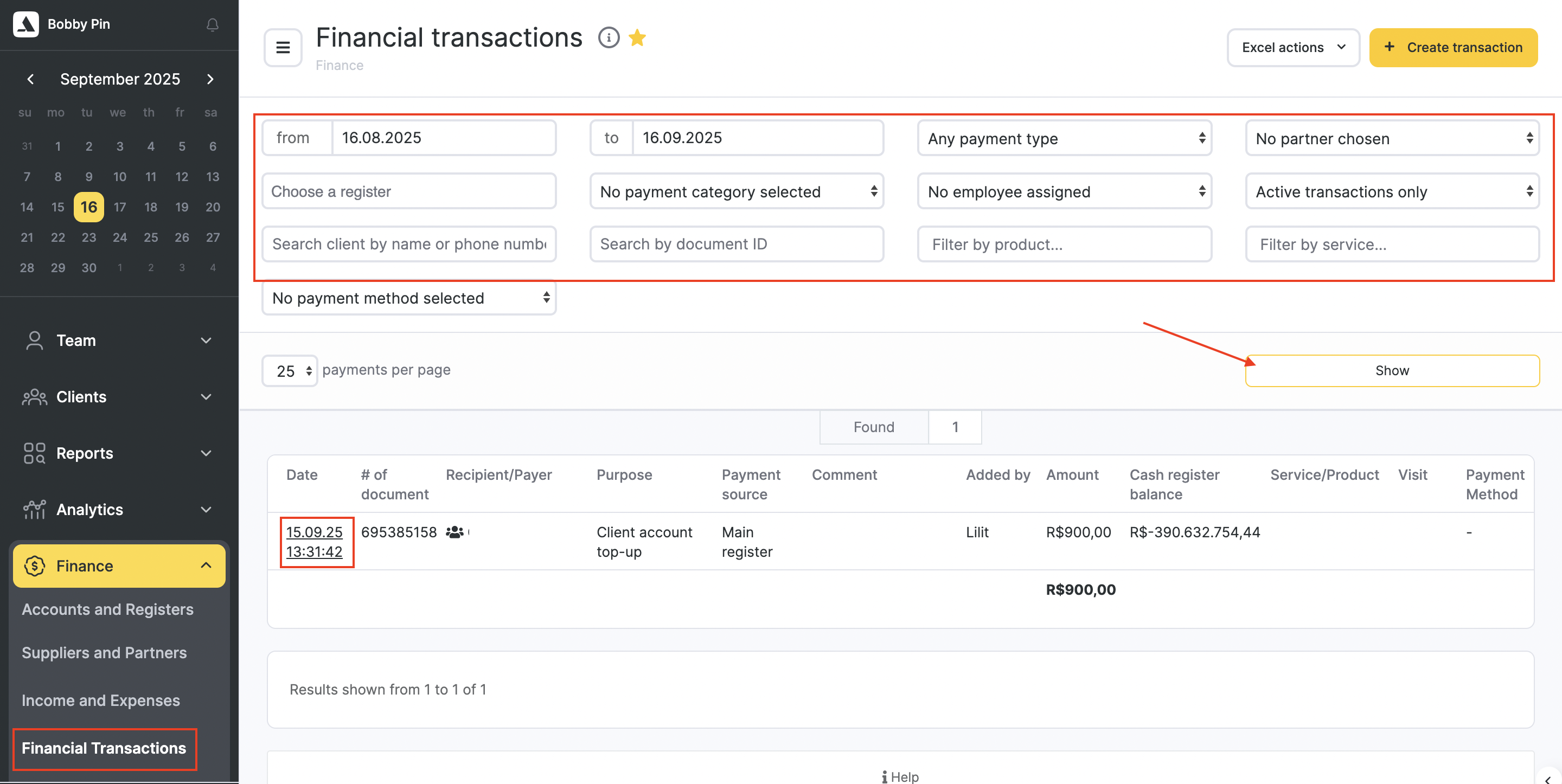

To cancel a customer’s account top-up, you need to cancel the top-up financial transaction in Finance > Financial Transactions. To delete the transaction:

- Go to Finance > Financial Transactions and find the required transaction. For quick search, use the Payment Item filter “Account Top-Up,” select the necessary dates, and, if needed, enter the customer’s name or phone number. Then click “Show.”

- In the first column, click the date/time of the transaction.

- The payment document will open — click the “Cancel” button in it.

This is the only way to refund an account top-up. However, if the refund is made on a day other than the day the customer’s account was topped up, it will create a discrepancy with the actual cash balance both on the top-up date and on the refund date.

As an alternative, you can create a separate service (or product) called “Refund” and debit the amount from the account to it. However, this will create a discrepancy in profit, so after such an operation you should create an expense transaction for the same amount to balance it out.

6. Partial Refund of a Deposit from a Client’s Personal Account

A partial refund of a customer’s deposit can only be done by debiting the amount to a product. After that, you need to create an expense transaction for the refund amount to balance the cash register on the refund date.

Since this is effectively a “conditional” product sale, you should first create a product called “Refund” (or something similar) so these sales are not included in reports.

7. Full Refund of a Membership Cost

A full refund of a membership can be done by canceling the sale of the product (membership).