Altegio now supports payments on credit via client personal accounts and their tracking. This means you can record visits paid partially or “on credit” (deposit in debt) and see this information right in the client card, visit history, and payroll reports. This article explains how it works and how to use it.

Where it’s shown #

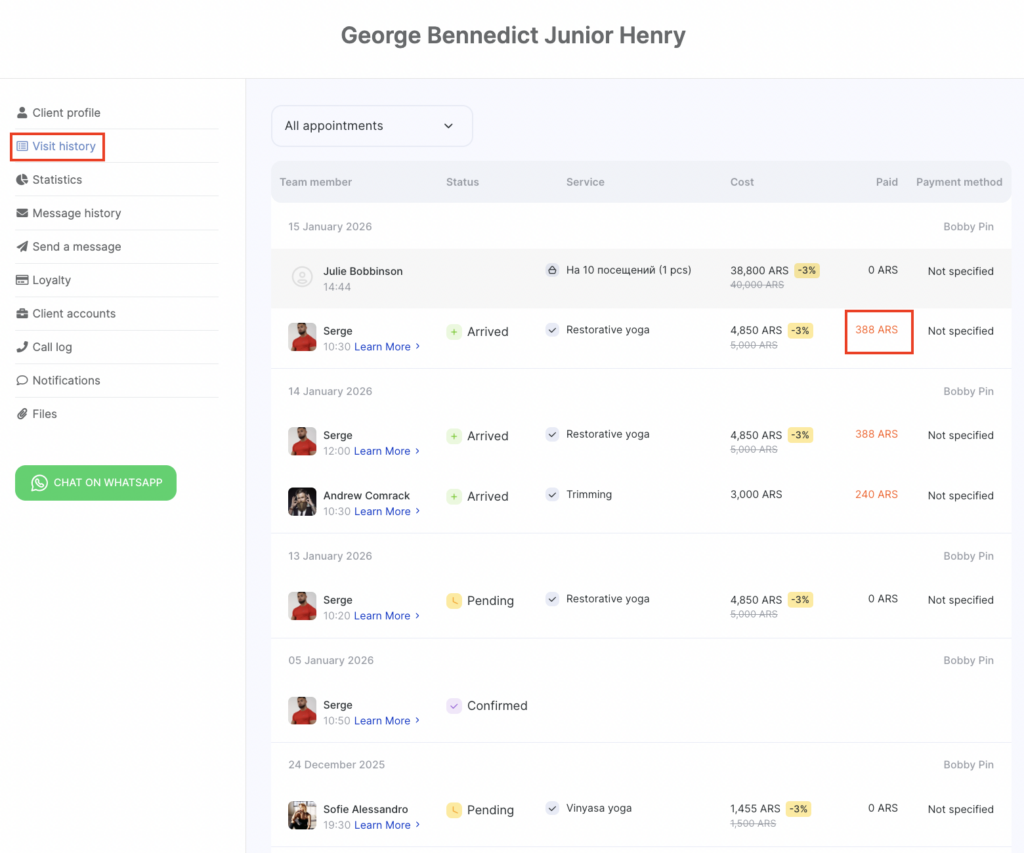

All deposits with the current balance are displayed in the client’s profile under Client Accounts.

Negative balances (debts) are highlighted in red, so you can immediately see whether the client has an outstanding amount and how much it is.

Any payment “on credit” or any payment made with a negative deposit is marked in red text or with a warning icon in the visit payment section.

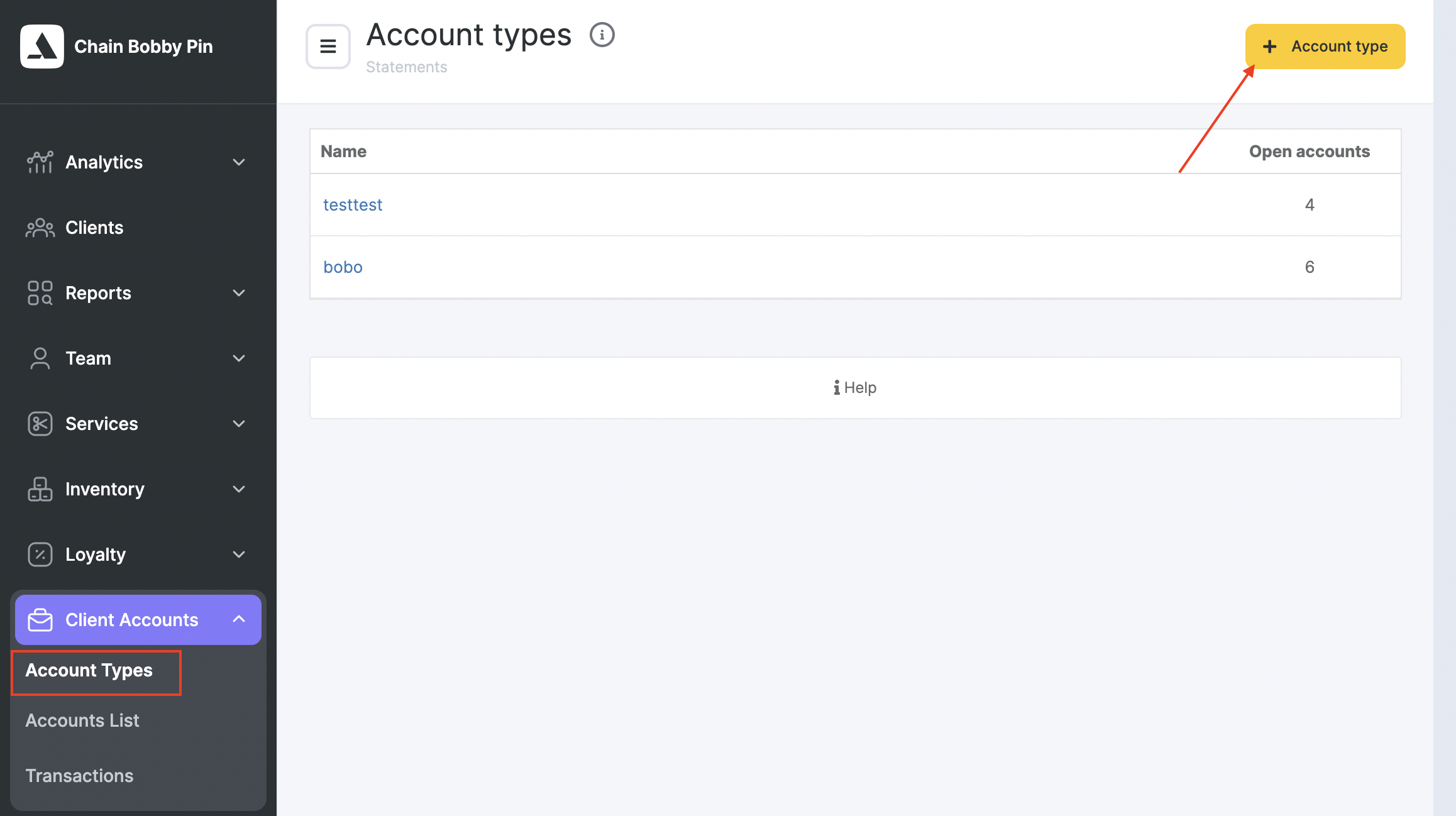

How to Enable the Feature #

- To enable this feature, go to chain interface Client Accounts > Account Types.

- Either create a new account type by clicking the button in the upper right corner, or select from available account types to edit.

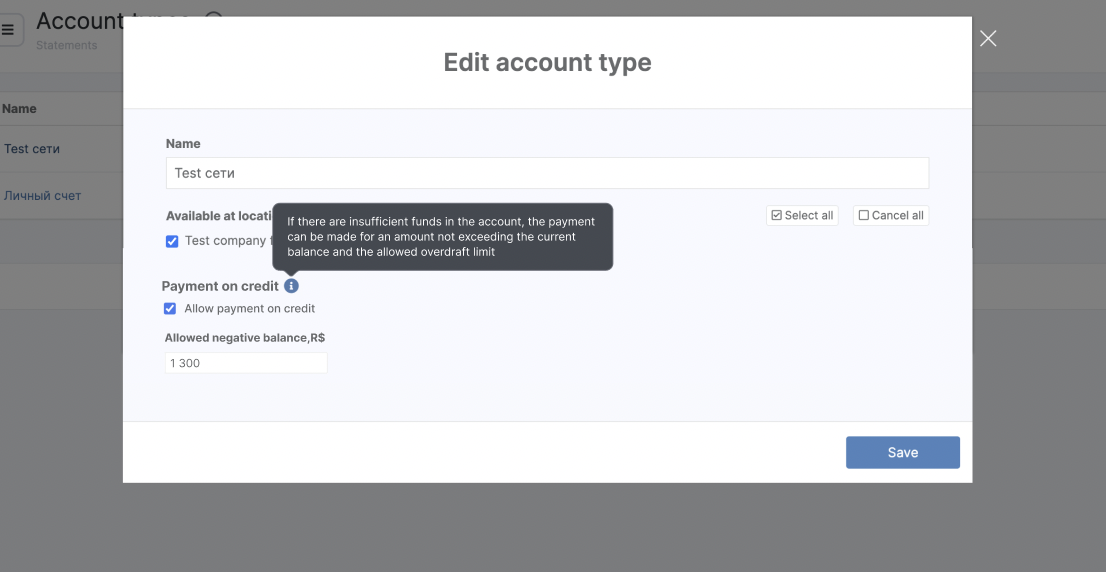

- A modal for editing account type will open.

- Edit the account type and mark for “Allow payment on credit”.

- Enter the maximum allowed negative amount (mandatory).

- Save changes.

Note

Make sure the allowed negative amount matches your internal credit policy for clients.

Making a Payment #

When creating a visit or checkout, choose Client’s Personal Account as the payment method. If the account does not have enough funds but negative balance is allowed, Altegio will:

- Deduct the amount and take the account below zero.

- Mark the payment as “on credit” in the visit history.

You’ll see a confirmation prompt before the payment completes, letting you know the client will go into debt.

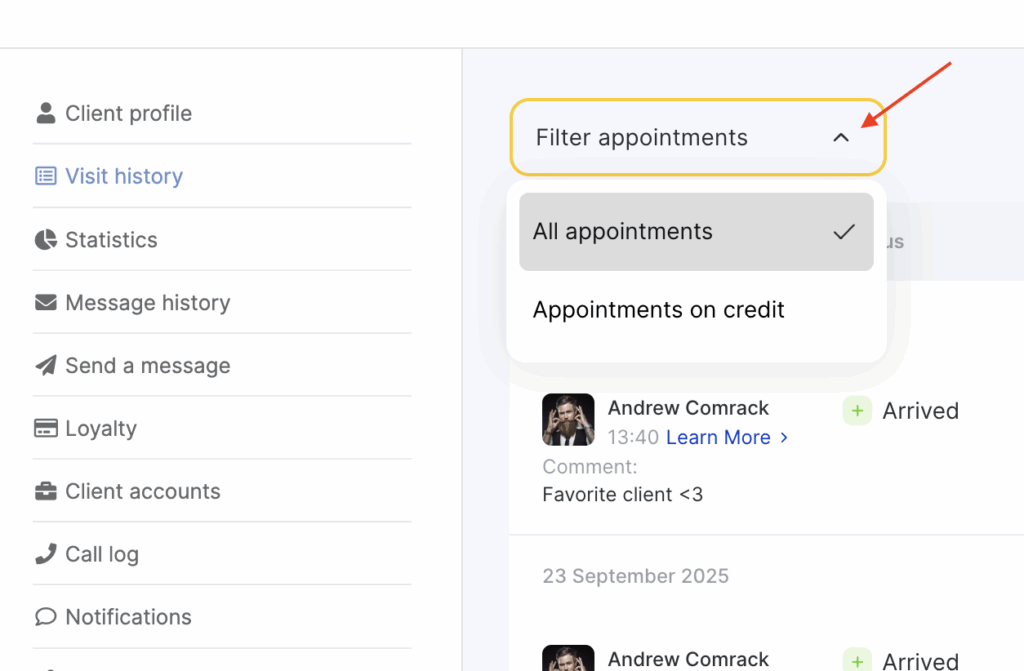

Filtering Clients with Debts #

In client card, use the filter “Filter appointments” to show only visits that are unpaid or paid on credit.

- All appointments shows everything.

- Unpaid appointments shows all client appointments that are not paid.

- Appointments on credit shows unpaid or in debt visits.

Payroll Settings for Team #

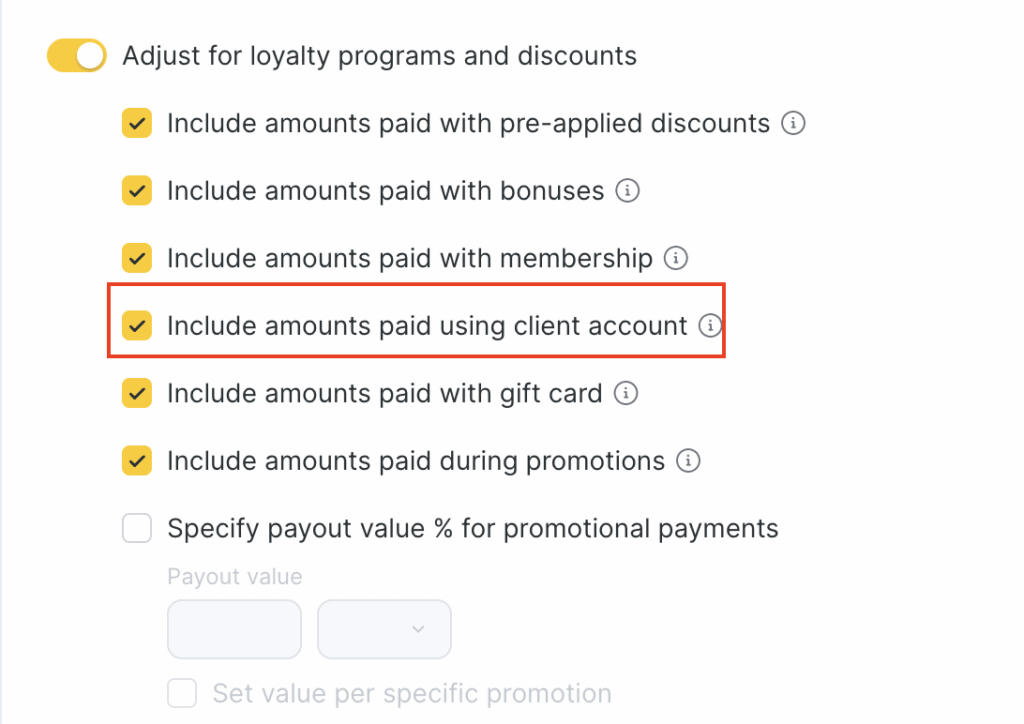

If you pay commissions based on completed visits, you can now decide whether or not to include unpaid/debt visits:

- Go to Settings > Team > Payroll (in team member’s profile).

- Tick the new “Include amounts paid using client account” checkbox (one for services and one for products).

- Save changes.

If the payment is made from the client’s account on credit, you can check the box and the salary will be accrued. But if the box is not checked, the salary from paid client accounts will not be accrued.

Please note

The negative balance applies only to payments you process manually. This does not affect online booking payments.